Market By Medium, Type, Application And Geography | Forecast 2019-2027

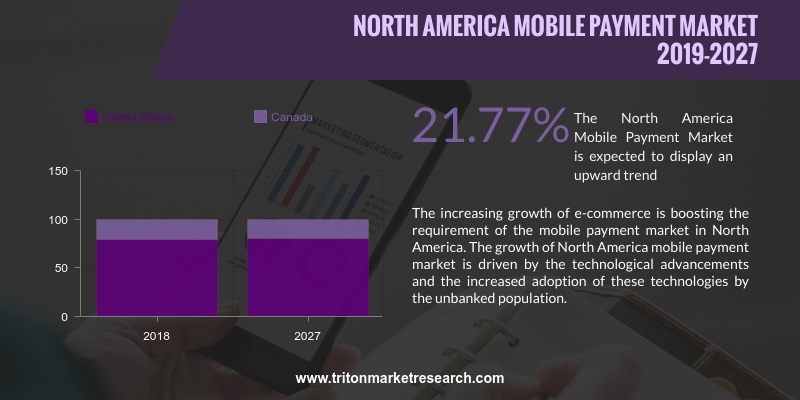

Triton Market Research’s report on the North America mobile payment market suggests that the market is expected to grow in terms of revenue with a CAGR of 21.77% during the forecast period 2019-2027.

Countries that have been studied in the North America mobile payment market are:

• The United States

• Canada

Mobile payment is a type of payment method in which the customer makes use of a mobile device in order to carry out monetary transaction. This method is an alternative to paying money via cash, check, or credit/debit cards for the purchase of various goods or services. Despite the idea of utilizing non-coin-based cash transactions has been prevalent since a long time, it is only of late that the innovation to make these changes have turned out to be generally available. The North American mobile payment market can be classified based on the type of payment and medium.

Report scope can be customized per your requirements. Request For Customization

The growth in the e-commerce industry is largely responsible for the large-scale adoption of mobile payment systems in North America. A payment system called Near Field Communication (NFC) is now being incorporated into mobile phones to make a digital wallet. Moreover, mobile payment is a favorable option as compared to other payment modes. The entry of tech giants such as Apple and Google has generated tremendous scope for the proliferation of the global mobile payments market. Companies like Paypal, MCX, Braintree, etc. have been in the market since long. Mobile payments systems need to develop technology that can provide a universal mode of payment. Varying set of standards for usage and lack of consensus among major market players has impeded market growth.

The report from Triton discusses the market definition and key industrial insights about the mobile payment market in North America. Also, the industrial player positioning, key market strategies, information about the evolution of the payment market, Porter’s five force analysis, vendor scorecard and the market attractiveness matrix has been provided.

1. NORTH

AMERICA MOBILE PAYMENT MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. MOBILE

PERSON-TO-PERSON TRANSFER (P2P) DOMINATES THE GLOBAL MOBILE PAYMENT MARKET BY

TYPE OF PAYMENT

2.2.2. CONTACTLESS

MEDIUM FOR MOBILE PAYMENT TO GROW AT SIGNIFICANT RATE

2.2.3. RETAIL

INDUSTRY SHOWS A LARGE DEMAND IN THE MOBILE PAYMENT MARKET

2.3. EVOLUTION

& TRANSITION OF MOBILE PAYMENT

2.4. PORTER'S

FIVE FORCE ANALYSIS

2.5. MARKET

ATTRACTIVENESS MATRIX

2.6. VENDOR

SCORECARD

2.7. INDUSTRY

PLAYER POSITIONING

2.8. KEY

MARKET STRATEGIES

2.9. MARKET

DRIVERS

2.9.1. GROWTH

IN E-COMMERCE

2.9.2. INORGANIC

GROWTH VIA MERGERS AND ACQUISITIONS

2.9.3. MOBILE

PAYMENT IS BEING PREFERRED OVER TRADITIONAL BANKING METHODS

2.9.4. MOBILE

PAYMENTS BEING ACCEPTED BY SMALL MERCHANTS AND BUSINESSES

2.9.5. TECHNOLOGICAL

ADVANCEMENT

2.9.6. UNBANKED

POPULATION OPTING FOR EXTENSIVE USE OF MOBILE

2.10.

MARKET RESTRAINTS

2.10.1.

SECURITY CONCERN

2.10.2.

INTEROPERABILITY IS A KEY

CONCERN

2.10.3.

SPYWARE AND MALWARE ATTACKS

MAY SLOW DOWN THE MARKET

2.11.

MARKET OPPORTUNITIES

2.11.1.

EMPHASIS ON USER-CONVENIENCE

GIVING RISE TO ADOPTION OF MOBILE PAYMENT SYSTEMS

2.11.2.

ENTRY OF BIG PLAYERS IN MOBILE

PAYMENT MARKET

2.11.3.

GROWING SMART CITY PROJECTS

2.11.4.

INTRODUCTION OF MORE

USER-FRIENDLY TECHNOLOGIES

2.11.5.

LIMITATIONS ON CASH

TRANSACTION

2.11.6.

UNBANKED GEOGRAPHIES ARE THE

OPPORTUNITY MARKETS

2.12.

MARKET CHALLENGES

2.12.1.

ADDRESSING THE COMPLEXITIES IS

A CONCERN

2.12.2.

HUGE CAPITAL REQUIREMENT

2.12.3.

LACK OF TECHNOLOGICAL

STANDARDS

2.12.4.

LATE ARRIVAL SCENARIO AND LACK

OF INDUSTRY STANDARD

2.12.5.

MOBILE PAYMENTS NEED TO CREATE

SPACE FOR LONG-TERM GROWTH

2.12.6.

NEW ADDITIONS TO THE

TECHNOLOGY AND UNCLEAR RULES CONFUSE THE MARKET PLAYERS AND CUSTOMERS

2.12.7.

RELUCTANCE TO SWITCH TO NEW

TECHNOLOGY

3. MOBILE

PAYMENT MARKET OUTLOOK - BY MEDIUM

3.1. SMS

3.2. INTERNET

3.3. CONTACTLESS

3.4. USSD

4. MOBILE

PAYMENT MARKET OUTLOOK - BY TYPE

4.1. MOBILE

PERSON-TO-PERSON TRANSFER (P2P)

4.2. MOBILE

COMMERCE (POS)

4.3. PREPAID

MOBILE WALLET

4.4. IN-APP BILLING

4.5. CARRIER

BILLING

4.6. CLOSED

LOOP PAYMENTS

5. MOBILE

PAYMENT MARKET OUTLOOK - BY APPLICATION

5.1. HEALTHCARE

5.2. RETAIL

5.3. ENERGY

& UTILITIES

5.4. HOSPITALITY

AND TRANSPORTATION

5.5. ENTERTAINMENT

5.6. OTHER

APPLICATIONS

6. MOBILE

PAYMENT MARKET - NORTH AMERICA

6.1. UNITED

STATES

6.2. CANADA

7. COMPETITIVE

LANDSCAPE

7.1. APPLE,

INC.

7.2. ALIPAY

7.3. BOKU

7.4. BANK

OF AMERICA

7.5. BANCO

BILBAO VIZCAYA ARGENTARIA WALLET

7.6. CHINA

UNIONPAY

7.7. MERCHANT

CUSTOMER EXCHANGE

7.8. M-PESA

7.9. DWOLLA

CORP.

7.10.

GOOGLE

7.11.

IZETTLE

7.12.

INTUIT PAY

7.13.

MASTERCARD

7.14.

SQUARE, INC.

7.15.

TENPAY

TECHNOLOGY, LTD.

7.16.

THE WESTERN UNION COMPANY

7.17.

WE PAY, INC.

7.18.

SOFTCARD

7.19.

PAYTM

7.20.

PAYPAL

7.21.

PAYMENTWALL

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1. MARKET

ATTRACTIVENESS MATRIX FOR MOBILE PAYMENT MARKET

TABLE 2. VENDOR

SCORECARD OF MOBILE PAYMENT MARKET

TABLE 3. KEY STRATEGIC

DEVELOPMENTS IN MOBILE PAYMENT MARKET

TABLE 4. NORTH AMERICA

MOBILE PAYMENT MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ BILLION)

TABLE 5. NORTH AMERICA

MOBILE PAYMENT MARKET, BY TYPE, 2019-2027 (IN $ BILLION)

TABLE 6. NORTH AMERICA

MOBILE PAYMENT MARKET, BY MEDIUM, 2019-2027 (IN $ BILLION)

TABLE 7. NORTH AMERICA

MOBILE PAYMENT MARKET, BY APPLICATION, 2019-2027 (IN $ BILLION)

FIGURE 1. NORTH AMERICA

MOBILE PAYMENT MARKET, 2019-2027 (IN $ BILLION)

FIGURE 2. PORTER’S FIVE

FORCE ANALYSIS OF MOBILE PAYMENT MARKET

FIGURE 3. TIMELINE OF

MOBILE PAYMENT

FIGURE 4. KEY PLAYER

POSITIONING IN 2018 (%)

FIGURE 5. NORTH AMERICA

MOBILE PERSON-TO-PERSON TRANSFER (P2P) MARKET 2019-2027 ($ BILLION)

FIGURE 6. NORTH AMERICA

MOBILE COMMERCE MARKET 2019-2027 ($ BILLION)

FIGURE 7. NORTH AMERICA

PREPAID MOBILE WALLET MARKET 2019-2027 ($ BILLION)

FIGURE 8. NORTH AMERICA

IN-APP BILLING MARKET 2019-2027 ($ BILLION)

FIGURE 9. NORTH AMERICA

CARRIER BILLING MARKET 2019-2027 ($ BILLION)

FIGURE 10. NORTH

AMERICA CLOSED-LOOP PAYMENTS MARKET 2019-2027 ($ BILLION)

FIGURE 11. NORTH

AMERICA SMS MARKET 2019-2027 ($ BILLION)

FIGURE 12. NORTH

AMERICA INTERNET MARKET 2019-2027 ($ BILLION)

FIGURE 13. NORTH

AMERICA CONTACTLESS MARKET 2019-2027 ($ BILLION)

FIGURE 14. NORTH

AMERICA USSD MARKET 2019-2027 ($ BILLION)

FIGURE 15. NORTH

AMERICA MOBILE PAYMENT MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 16. NORTH

AMERICA MOBILE PAYMENT MARKET, BY HEALTHCARE, 2019-2027 (IN $ BILLION)

FIGURE 17. NORTH

AMERICA MOBILE PAYMENT MARKET, BY RETAIL, 2019-2027 (IN $ BILLION)

FIGURE 18. NORTH

AMERICA MOBILE PAYMENT MARKET, BY ENERGY & UTILITIES, 2019-2027 (IN $

BILLION)

FIGURE 19. NORTH

AMERICA MOBILE PAYMENT MARKET, BY HOSPITALITY AND TRANSPORTATION, 2019-2027 (IN

$ BILLION)

FIGURE 20. NORTH

AMERICA MOBILE PAYMENT MARKET, BY ENTERTAINMENT, 2019-2027 (IN $ BILLION)

FIGURE 21. NORTH

AMERICA MOBILE PAYMENT MARKET, BY OTHER APPLICATIONS, 2019-2027 (IN $ BILLION)

FIGURE 22. NORTH

AMERICA MOBILE PAYMENT MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 23. UNITED

STATES MOBILE PAYMENT MARKET, 2019-2027 (IN $ BILLION)

FIGURE 24. CANADA

MOBILE PAYMENT MARKET, 2019-2027 (IN $ BILLION)