Market By Types, End-users And Geography | Forecast 2019-2027

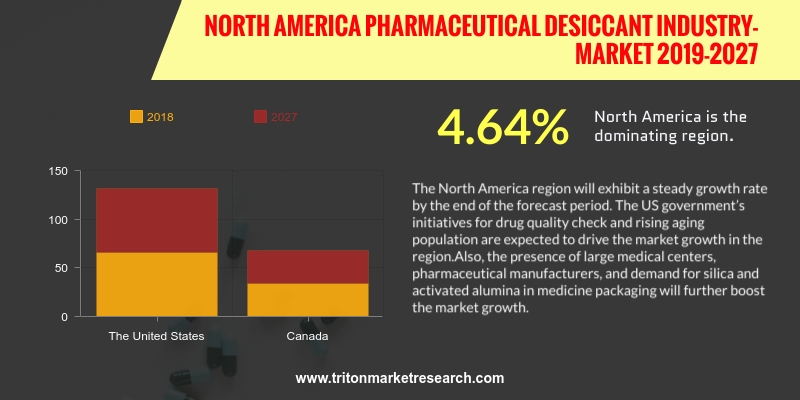

After studying the pharmaceutical desiccant market in North America, Triton Market Research has concluded that the market is projected to grow with a CAGR of 4.64% over the estimated period of 2019-2027.

The countries that have been scrutinized in the North America pharmaceutical desiccant market are:

• The United States

• Canada

North America is one of the leading markets for pharmaceutical desiccants, which find extensive use in the region's oil & gas, petrochemical and pharmaceutical industries. Pharmaceutical desiccants are required in pharmaceutical packaging for protecting medicines from moisture and other impurities. North America accounted for more than 29% of the revenue in the global pharmaceutical industry in 2017. The strong pharmaceutical manufacturing base in the region, due to supportive government regulations and high R&D expenditure, bodes well for the growth of the market.

Report scope can be customized per your requirements. Request For Customization

In North America, activated alumina is preferred as a desiccant for the oil & gas, pharmaceutical and chemical industries. Activated alumina is most efficiently used for dehumidifying natural gas lines. Companies have designed specialized activated alumina that can absorb liquids efficiently. The molecular sieves market in North America is expected to grow steadily over the next five years, owing to the growing shale gas extraction in the US. The increasing oil production in the Gulf of Mexico is subsequently driving the downstream application markets and will also propel the growth of the molecular sieves markets in the region.

The silica gel market in North America is expected to grow at a constant rate during the forecast period. Silica gel is being used extensively in the region as a matting agent for surface coating applications. For instance, PQ Corporation's GASIL, a silica gel-based product, has gained significant popularity among the paints & coatings manufacturers in recent years. The North American market comprises of the most attractive international companies looking to launch innovative pharmaceuticals. The US is ranked first globally, while the region’s second-ranked country is Canada, which ranks eighth globally.

Multisorb Technologies is a provider of sorbent products, headquartered in Buffalo, New York, the United States. It provides desiccants, moisture management products, spill control materials, odour absorbers, oxygen absorbers and other speciality sorbents. Multisorb markets its products under various brand names such as StripPax, MiniPax, SaniSorb, StabilOx, DesiCap, Humonitor, TranSorb, Dri-Can and FreshPax. The company caters its products to the healthcare, food & beverage, storage, government, electronics and transportation industries. It operates through its offices located in the US and the UK.

1. NORTH

AMERICA PHARMACEUTICAL DESICCANT MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES ANALYSIS

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. BARGAINING

POWER OF SUPPLIERS

2.2.3. BARGAINING

POWER OF BUYERS

2.2.4. THREAT

OF SUBSTITUTES

2.2.5. COMPETITIVE

RIVALRY

2.3. VENDOR

SCORECARD

2.4. SUPPLY

CHAIN ANALYSIS

2.5. KEY

INSIGHT

2.6. MARKET

DRIVERS

2.6.1. INCREASING

GERIATRIC POPULATION

2.6.2. GOVERNMENT

INITIATIVES TAKEN TO ENSURE QUALITY OF DRUGS

2.6.3. CONTINUOUS

GROWTH IN THE PHARMACEUTICAL INDUSTRY

2.7. MARKET

RESTRAINTS

2.7.1. VARIABLE

TEMPERATURES HAMPER PHARMACEUTICAL PRODUCTS

2.7.2. STRINGENT

REGULATIONS

2.8. MARKET

OPPORTUNITIES

2.8.1. ESTABLISHMENT

OF STRONGER PRESENCE IN VARYING CONSUMER PREFERENCES

2.9. MARKET

CHALLENGES

2.9.1. GROWING

CUSTOMER EXPECTANCIES

2.9.2. PRICING

IS MARKET-BASED RATHER THAN COST-BASED

3. PHARMACEUTICAL

DESICCANT MARKET OUTLOOK - BY TYPES

3.1. SILICA

GEL

3.2. ACTIVATED

ALUMINA

3.3. CARBONCLAY

DESICCANT

3.4. MOLECULAR

SIEVES

3.5. OTHER

TYPES

4. PHARMACEUTICAL

DESICCANT MARKET OUTLOOK - BY END-USERS

4.1. TABLETS

4.2. APIs

4.3. CAPSULES

4.4. NUTRACEUTICAL

PRODUCT PACKAGING

4.5. DIAGNOSTIC

KITS

5. PHARMACEUTICAL

DESICCANT MARKET - REGIONAL OUTLOOK

5.1. NORTH

AMERICA

5.1.1. COUNTRY

ANALYSIS

5.1.1.1. THE

UNITED STATES

5.1.1.2. CANADA

6. COMPANY

PROFILES

6.1. CAPITOL

SCIENTIFIC, INC.

6.2. CLARIANT

NORTH AMERICA

6.3. CSP

TECHNOLOGIES, INC.

6.4. DESICCARE,

INC.

6.5. E.

I. DU PONT DE NEMOURS AND COMPANY

6.6. MULTISORB

TECHNOLOGIES

6.7. MUNTERS

AB

6.8. OKER-CHEMIE

GMBH

6.9. PROFLUTE

AB

6.10.

ROTOR SOURCE, INC.

6.11.

SANNER GMBH

6.12.

W. R. GRACE & CO.

7. METHODOLOGY

AND SCOPE

7.1. RESEARCH

SCOPE

7.2. SOURCES

OF DATA

7.3. RESEARCH

METHODOLOGY

TABLE 1 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET 2019-2027 ($ MILLION)

TABLE 2 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET BY TYPES 2019-2027 ($ MILLION)

TABLE 3 NORTH AMERICA PHARMACEUTICAL DESICCANT MARKET

BY END-USERS 2019-2027 ($ MILLION)

TABLE 4 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET BY COUNTRIES 2019-2027 ($ MILLION)

FIGURE 1 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET 2019-2027 ($ MILLION)

FIGURE 2 PORTER’S FIVE FORCES ANALYSIS OF NORTH

AMERICA PHARMACEUTICAL DESICCANT MARKET

FIGURE 3 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET IN SILICA GEL 2019-2027 ($ MILLION)

FIGURE 4 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET IN ACTIVATED ALUMINA 2019-2027 ($ MILLION)

FIGURE 5 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET IN CARBONCLAY DESICCANT 2019-2027 ($ MILLION)

FIGURE 6 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET IN MOLECULAR SIEVE 2019-2027 ($ MILLION)

FIGURE 7 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET IN OTHER TYPES 2019-2027 ($ MILLION)

FIGURE 8 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET IN DESICCANT TABLETS 2019-2027 ($ MILLION)

FIGURE 9 NORTH AMERICA PHARMACEUTICAL DESICCANT

MARKET IN API 2019-2027 ($ MILLION)

FIGURE 10 NORTH AMERICA PHARMACEUTICAL DESICCANT MARKET

IN DESICCANT CAPSULES 2019-2027 ($ MILLION)

FIGURE 11 NORTH AMERICA PHARMACEUTICAL DESICCANT MARKET

IN NUTRACEUTICAL PRODUCTS PACKAGING 2019-2027 ($ MILLION)

FIGURE 12 NORTH AMERICA PHARMACEUTICAL DESICCANT MARKET

IN DIAGNOSTIC KITS 2019-2027 ($ MILLION)

FIGURE 13 THE UNITED STATES PHARMACEUTICAL DESICCANT

MARKET 2019-2027 ($ MILLION)

FIGURE 14 CANADA PHARMACEUTICAL DESICCANT MARKET

2019-2027 ($ MILLION)