Market By Deployment, Type, Application And Geography | Forecast 2019-2027

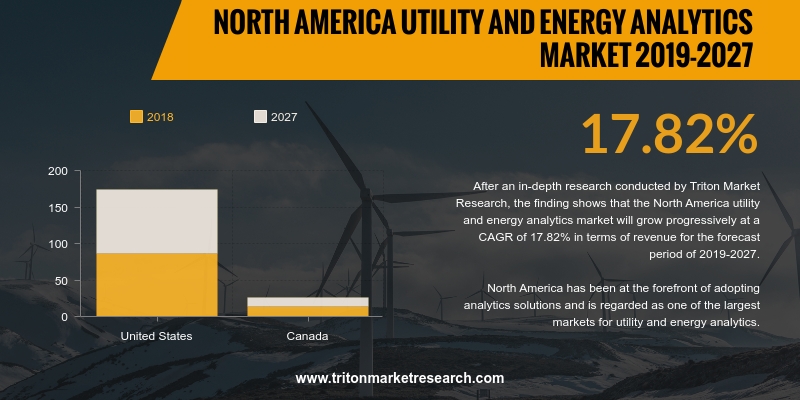

After in-depth research conducted by Triton Market Research, the finding shows that the North America utility and energy analytics market will grow progressively at a CAGR of 17.82% in terms of revenue for the forecast period of 2019-2027.

The countries that have been analyzed in the utility and energy analytics market in North America are:

• The United States

• Canada

Report scope can be customized per your requirements. Request For Customization

North America has been at the forefront of adopting analytics solutions and is regarded as one of the largest markets for utility and energy analytics. Greater focus on innovations through research & development along with the technological advancement in developed economies like Canada and the United States primarily drive the demand in this region. A large amount of energy consumption in this region also supports the growth of the utility and energy analytics market. Furthermore, North America has a strong presence of renowned market vendors, such as Oracle Corporation, IBM Corporation, SAS Institute Inc. and Building IQ, among others.

The US Energy Information Administration predicts the total energy consumption in the region to rise by 5% from 2016 to 2040. Such less growth compels the companies to reduce downtime for efficiently maintaining profitability. This factor propels the market for utility and energy analytics. Moreover, power supply companies in North America have started to explore new technologies to cater to increasingly sophisticated customers accustomed to other industries aiming at providing them a high-tech digital experience.

SAS Institute, Inc. is a leading company that provides business intelligence and analytics software & services. It offers a variety of enterprise solutions consisting of AI solutions; advanced analytics; IoT solutions; business intelligence & analytics; small & mid-size business; risk management; personal data protection; and supply chain intelligence. The company’s data management products include data integration & access; data preparation; data quality; data governance; mobile device management (MDM); and event stream processing products. Customer intelligence products by the company include customer journey optimization; real-time customer experience; analytical marketing; and ecosystem excellence products. SAS Institute is based in the United States.

1. NORTH AMERICA UTILITY AND ENERGY ANALYTICS

MARKET - SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

HYBRID ANALYTICS IS FASTEST-GROWING IN DEPLOYMENT

2.2.2.

DISTRIBUTION PLANNING SECTOR IS THE FASTEST-GROWING APPLICATION

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. KEY IMPACT ANALYSIS

2.4.1.

PRICE

2.4.2.

MODE OF DEPLOYMENT

2.4.3.

APPLICATION

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. MARKET DRIVERS

2.7.1.

GROWING CONSUMER FOCUS ON ENERGY CONSUMPTION PATTERN ANALYSIS

2.7.2.

DEMAND FOR ENERGY AND UTILITY ANALYTICS INCREASES WITH EMPHASIS ON

RENEWABLE ENERGY

2.8. MARKET RESTRAINTS

2.8.1.

DEPLOYMENT REQUIRES HIGH CAPITAL INVESTMENT

2.9. MARKET OPPORTUNITIES

2.9.1.

ENERGY AND UTILITY INDUSTRY ADOPTS CLOUD TECHNOLOGY

2.9.2.

DEVELOPMENT OF SMART CITIES AND INFRASTRUCTURES

2.10. MARKET CHALLENGES

2.10.1. SECURITY ISSUES

2.10.2. LACK OF INDUSTRIAL EXPERTISE

3. NORTH AMERICA UTILITY AND ENERGY ANALYTICS

MARKET OUTLOOK - BY DEPLOYMENT

3.1. CLOUD

3.2. ON-PREMISES

3.3. HYBRID

4. NORTH AMERICA UTILITY AND ENERGY ANALYTICS

MARKET OUTLOOK - BY TYPE

4.1. SOFTWARE

4.2. SERVICES

5. NORTH AMERICA UTILITY AND ENERGY ANALYTICS

MARKET OUTLOOK - BY APPLICATION

5.1. METER OPERATION

5.2. LOAD FORECASTING

5.3. DEMAND RESPONSE

5.4. DISTRIBUTION PLANNING

5.5. OTHER APPLICATIONS

6. NORTH AMERICA UTILITY AND ENERGY ANALYTICS

MARKET - REGIONAL OUTLOOK

6.1. UNITED STATES

6.2. CANADA

7. COMPETITIVE LANDSCAPE

7.1. CAPGEMINI SE

7.2. ORACLE CORPORATION

7.3. ABB CORPORATION

7.4. SAS INSTITUTE INC.

7.5. SIEMENS AG

7.6. IBM CORPORATION

7.7. GENERAL ELECTRIC COMPANY

7.8. SAP SE

7.9. INFOSYS LIMITED

7.10. WIPRO LIMITED

7.11. BUILDING IQ INC.

7.12. SCHNEIDER ELECTRIC SE

7.13. TERADATA CORPORATION

7.14. CISCO SYSTEMS INC.

7.15. EATON CORPORATION

8. RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

TABLE 2: VENDOR SCORECARD

TABLE 3: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY

DEPLOYMENT, 2019-2027 (IN $ MILLION)

TABLE 4: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY TYPE,

2019-2027 (IN $ MILLION)

TABLE 5: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY

APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 6: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

FIGURE 1: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY

APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: HYBRID UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 3: DISTRIBUTION PLANNING UTILITY AND ENERGY ANALYTICS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 4: PORTER’S FIVE FORCE ANALYSIS

FIGURE 5: KEY BUYING IMPACT ANALYSIS

FIGURE 6: MARKET ATTRACTIVENESS INDEX

FIGURE 7: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY CLOUD,

2019-2027 (IN $ MILLION)

FIGURE 8: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY

ON-PREMISES, 2019-2027 (IN $ MILLION)

FIGURE 9: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY HYBRID,

2019-2027 (IN $ MILLION)

FIGURE 10: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY

SOFTWARE, 2019-2027 (IN $ MILLION)

FIGURE 11: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY SERVICE,

2019-2027 (IN $ MILLION)

FIGURE 12: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY METER

OPERATION, 2019-2027 (IN $ MILLION)

FIGURE 13: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY LOAD

FORECASTING, 2019-2027 (IN $ MILLION)

FIGURE 14: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY DEMAND

RESPONSE, 2019-2027 (IN $ MILLION)

FIGURE 15: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY

DISTRIBUTION PLANNING, 2019-2027 (IN $ MILLION)

FIGURE 16: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, BY OTHER

APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 17: NORTH AMERICA UTILITY AND ENERGY ANALYTICS MARKET, REGIONAL

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 18: UNITED STATES UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 19: CANADA UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027 (IN $

MILLION)