Market By Technology, Type Of Waste, Municipal Solid Waste (MSW), Application, And Geography | Forecast 2019-2027

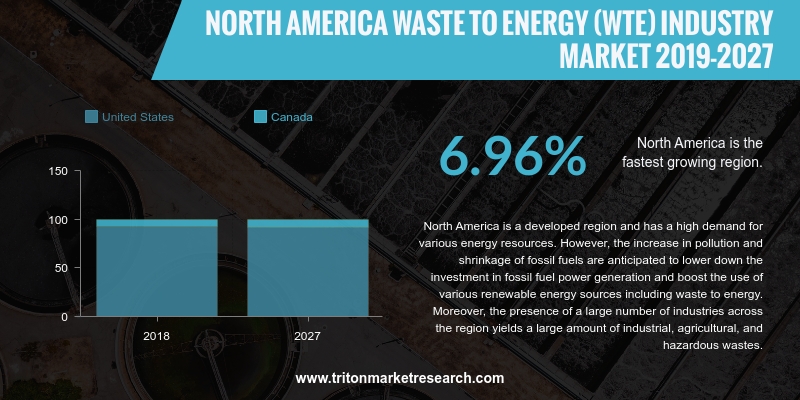

Triton has concluded the North American waste-to-energy market to grow with a CAGR of 6.96% in the forecasting years of 2019-2027.

The countries assessed in the North America market for waste-to-energy are:

• The United States

• Canada

As a result of the massive quantities of waste generated in the US, North America has become one of the largest regions generating waste, globally. Unfortunately, WtE technologies in the region have not yet developed at the same rate at the waste generated in the region. There is a lack of suitable policies and regulations concerning WtE in the region. However, the North American market holds immense potential for growth in the coming years, due to the decrease in the availability of space for landfilling and the shift toward renewable energy development.

Report scope can be customized per your requirements. Request For Customization

The United States has been one of the leading adopters of WtE technologies in the world; however, in comparison with other nations, the size of the WtE market in the US is extremely small. The country primarily uses landfilling to process the municipal solid waste it generates. However, the diminishing available space for landfilling and the increasing environmental hazards of landfills have urged the adoption of WtE technologies in the US.

According to the life cycle emission analysis by the US Environmental Protection Agency, waste-to-energy facilities help in reducing the presence of greenhouse gases. The presence of greenhouse gases reduces by a certain margin for each ton of municipal waste that is incinerated. This has led to the government introducing numerous favorable initiatives, such as the Energy Policy Act of 2005, the Federal Power Act in 2010, the American Jobs Creation Act in 2006, and the American Tax Payer Relief Act in 2012.

Covanta Holding Corporation is a company providing sustainable solutions for waste and energy. It is also involved in other businesses concerning waste disposal and renewable energy. The company offers solutions for electronic waste recycling, municipal solid waste treatment, and treatment of non-hazardous materials. Covanta Holding owns WtE facilities and operates infrastructure for converting waste-to-energy; it also owns facilities for generating energy and other facilities producing renewable energy in North America. The US-based company is headquartered in Morristown, New Jersey, and has an employee strength of over 3500. Covanta acquired Chief Industrial Services in January 2016.

1. NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. DATA

ANALYTICS & BIG DATA OPTIMIZING WASTE MANAGEMENT VALUE CHAIN

2.2.2. INCINERATION

– KEY THERMAL WASTE-TO-ENERGY TECHNOLOGY

2.2.3. GROWING

PROMINENCE OF BIOLOGICAL WTE TECHNOLOGY

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. BARGAINING

POWER OF BUYERS

2.3.2. BARGAINING

POWER OF SUPPLIERS

2.3.3. THREAT

OF SUBSTITUTE

2.3.4. THREAT

OF NEW ENTRANTS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. KEY

IMPACT ANALYSIS

2.4.1. COST

2.4.2. ENVIRONMENT-FRIENDLY

2.4.3. SUBSTITUTES

2.4.4. AVAILABILITY

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. INDUSTRY

COMPONENTS

2.7.1. WASTE

GENERATION

2.7.2. WASTE

COLLECTION

2.7.3. SUPPLIERS

2.7.4. MANUFACTURERS

2.7.5. DISTRIBUTORS

& RETAILERS

2.7.6. END-USERS

2.8. MARKET

DRIVERS

2.8.1. RISING

ENERGY DEMAND & NEED FOR ENERGY SECURITY

2.8.2. SUBSTANTIAL

INVESTMENTS IN NEW WTE PROJECTS

2.8.3. RAPID

INDUSTRIALIZATION & URBANIZATION CONTRIBUTING TO THE INCREASING MUNICIPAL

WASTE

2.8.4. DECLINING

NUMBER OF LANDFILL SITES

2.9. MARKET

RESTRAINTS

2.9.1. HIGH

SETUP COST – MAJOR DRAWBACK

2.9.2. AVAILABILITY

OF ALTERNATIVE TECHNOLOGIES

2.9.3. STRICT

ENVIRONMENTAL GUIDELINES

2.10.

MARKET OPPORTUNITIES

2.10.1. DEPLETING

CONVENTIONAL ENERGY RESOURCES

2.10.2. EMERGING

TECHNOLOGIES

2.11.

MARKET CHALLENGES

2.11.1. TECHNOLOGICAL

CHALLENGES

2.11.2. OPPOSITION

FROM ENVIRONMENTAL GROUPS & LOCAL COMMUNITIES

3. NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET OUTLOOK – BY TECHNOLOGY

3.1. THERMAL

3.2. BIOLOGICAL

3.3. PHYSICAL

4. NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET OUTLOOK – BY TYPE OF WASTE

4.1. MUNICIPAL

WASTE

4.1.1. RESIDENTIAL

4.1.2. COMMERCIAL

& INSTITUTIONAL

4.1.3. CONSTRUCTION

& DEMOLITION

4.1.4. OTHER

MUNICIPAL WASTES

4.2. PROCESS

WASTE

4.3. MEDICAL

WASTE

4.4. AGRICULTURE

WASTE

4.5. OTHER

WASTES

5. NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET OUTLOOK – BY APPLICATION

5.1. ELECTRICITY

5.2. HEAT

5.3. COMBINED

HEAT & POWER UNITS

5.4. TRANSPORT

FUELS

5.5. OTHER

APPLICATIONS

6. NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET – REGIONAL OUTLOOK

6.1. UNITED

STATES

6.2. CANADA

7. COMPETITIVE

LANDSCAPE

7.1. AMEC

FOSTER WHEELER PLC (ACQUIRED BY WOOD GROUP)

7.2. BABCOCK

& WILCOX ENTERPRISES, INC.

7.3. C&G

ENVIRONMENTAL PROTECTION HOLDINGS LTD.

7.4. CHINA

EVERBRIGHT INTERNATIONAL LTD.

7.5. COVANTA

HOLDING CORPORATION

7.6. GREEN

CONVERSION SYSTEMS, INC.

7.7. HITACHI

ZOSEN CORPORATION

7.8. KEPPEL

SEGHERS

7.9. MITSUBISHI

HEAVY INDUSTRIES, LTD.

7.10.

PLASCO CONVERSION SYSTEMS

(ACQUIRED BY RMB ADVISORY SERVICES)

7.11.

SUEZ ENVIRONNEMENT COMPANY

7.12.

VEOLIA ENVIRONNEMENT S.A.

7.13.

WASTE MANAGEMENT, INC.

7.14.

WHEELABRATOR TECHNOLOGIES,

INC.

7.15.

XCEL ENERGY, INC.

7.16.

BTA INTERNATIONAL GMBH

7.17.

MARTIN GMBH

7.18.

ZE-GEN, INC.

7.19.

SAKO BRNO A.S.

7.20.

AUSTRIAN ENERGY &

ENVIRONMENT GROUP

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1: NORTH AMERICA

WASTE-TO-ENERGY (WTE) MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: ANTICIPATED

WTE PROJECTS ACROSS WORLD

TABLE 4: PROJECTED

WASTE GENERATION DATA FOR 2025, BY REGION

TABLE 5: COMPETING

RENEWABLE TECHNOLOGIES

TABLE 6: CARBON

EFFICIENCY OF SEVERAL BIOFUEL PRODUCTION PROCESSES

TABLE 7: NORTH AMERICA WASTE-TO-ENERGY

(WTE) MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 8: NORTH AMERICA

WASTE-TO-ENERGY (WTE) MARKET, BY TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 9: NORTH AMERICA

WASTE-TO-ENERGY (WTE) MARKET, BY TYPE OF WASTE, 2019-2027 (IN $ MILLION)

TABLE 10: NORTH AMERICA

WASTE-TO-ENERGY (WTE) MARKET, BY MUNICIPAL SOLID WASTE (MSW), 2019-2027 (IN $

MILLION)

TABLE 11: NORTH AMERICA

WASTE-TO-ENERGY (WTE) MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

FIGURE 1: MARKET

INVESTMENT FOR INCINERATION IN ASIA-PACIFIC, EUROPE AND NORTH AMERICA

FIGURE 2: KEY BUYING

IMPACT ANALYSIS

FIGURE 3: MARKET

ATTRACTIVENESS INDEX

FIGURE 4: INDUSTRY

COMPONENTS

FIGURE 5: WORLDWIDE GDP

GROWTH RATE AND TRENDS BY ECONOMY (ACTUAL AND PROJECTED), 2010-2025 (IN %)

FIGURE 6: WORLDWIDE

REGION-WISE ENERGY CONSUMPTION, 2015-2035 (MTOE = MILLION TON OF OIL

EQUIVALENT)

FIGURE 7: WORLDWIDE

AVAILABLE MUNICIPAL WASTE FOR WTE, 2009-2016 (MILLION TON)

FIGURE 8: WORLDWIDE

RENEWABLE ELECTRICITY INSTALLED CAPACITY, BY SOURCE, 2012-2019 (GW)

FIGURE 9: NORTH AMERICA

WASTE-TO-ENERGY (WTE) MARKET, BY THERMAL, 2019-2027 (IN $ MILLION)

FIGURE 10: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY BIOLOGICAL, 2019-2027 (IN $ MILLION)

FIGURE 11: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY PHYSICAL, 2019-2027 (IN $ MILLION)

FIGURE 12: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY MUNICIPAL WASTE, 2019-2027 (IN $

MILLION)

FIGURE 13: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY RESIDENTIAL, 2019-2027 (IN $ MILLION)

FIGURE 14: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY COMMERCIAL & INSTITUTIONAL,

2019-2027 (IN $ MILLION)

FIGURE 15: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY CONSTRUCTION & DEMOLITION,

2019-2027 (IN $ MILLION)

FIGURE 16: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY OTHER WASTES, 2019-2027 (IN $ MILLION)

FIGURE 17: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY PROCESS WASTE, 2019-2027 (IN $

MILLION)

FIGURE 18: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY MEDICAL WASTE, 2019-2027 (IN $

MILLION)

FIGURE 19: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY AGRICULTURE WASTE, 2019-2027 (IN $

MILLION)

FIGURE 20: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY OTHER WASTES, 2019-2027 (IN $ MILLION)

FIGURE 21: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY ELECTRICITY, 2019-2027 (IN $ MILLION)

FIGURE 22: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY HEAT, 2019-2027 (IN $ MILLION)

FIGURE 23: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY COMBINED HEAT & POWER UNITS,

2019-2027 (IN $ MILLION)

FIGURE 24: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY TRANSPORT FUELS, 2019-2027 (IN $

MILLION)

FIGURE 25: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, BY OTHER APPLICATIONS, 2019-2027 (IN $

MILLION)

FIGURE 26: NORTH

AMERICA WASTE-TO-ENERGY (WTE) MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 27: UNITED

STATES WASTE-TO-ENERGY (WTE) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: CANADA

WASTE-TO-ENERGY (WTE) MARKET, 2019-2027 (IN $ MILLION)