Market By Type, End-user, Application And Geography | Forecast 2019-2027

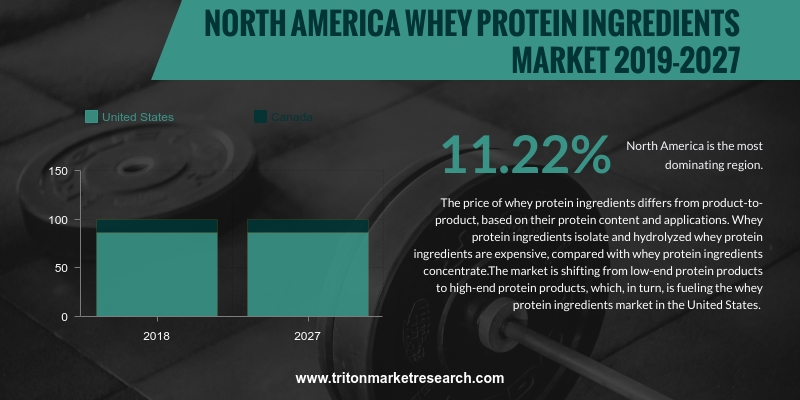

Triton Market Research has concluded that the North America whey protein ingredients market is projected to grow at a CAGR of 11.22% and 6.91% in terms of revenue and volume respectively, in the estimated years 2019-2027.

The report on the whey protein ingredients market in North America includes the countries of:

• United States

• Canada

Report scope can be customized per your requirements. Request For Customization

The price of whey protein ingredients differs from product-to-product, based on their protein content and applications. Whey protein ingredients isolate and hydrolyzed whey protein ingredients are expensive, compared with whey protein ingredients concentrate. The market is shifting from low-end protein products to high-end protein products, which, in turn, is fueling the whey protein ingredients market in the United States. The market is growing because of increasing demand for infant formula and baby foods containing whey protein ingredients, which are considered to be a nutritional substitute for breast milk. Further, increasing consumption of protein supplements in different forms, such as health drinks, vitamin tablets & functional foods by all age groups in the US and the steady growth of awareness among mass consumers have fueled investments in the technologies to improve the processing of whey protein ingredients. The country has more than 200 whey production plants. The US cheese production industry, which is also the largest globally, provides major production support to the whey industry. There have been noteworthy investments in this industry that have resulted in its steady growth.

Grande Custom Ingredients Group, a subsidiary of Grande Cheese Company, is a producer and supplier of functional ingredients. The company offers dairy ingredients including dried yoghurt, cultured dairy products, functional whey protein ingredients, whey protein ingredients isolate and whey protein ingredients crisps. It provides water holding and dairy-based products including soups, dressings, sauces, dips and others. Grande Custom markets its products under the brands of Grande Primo, Grande Bravo, Grande Ultra and Grande WPCrisp. The company’s products find applications in nutrition, snacks, beverages, and sweet & frozen products. It operates through a technology centre and test kitchen. The company markets its products in different parts of the United States. Grande Custom is headquartered in Lomira, Wisconsin, the US.

1. NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET

- SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCE ANALYSIS

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTE

2.2.3.

BARGAINING POWER OF SUPPLIERS

2.2.4.

BARGAINING POWER OF BUYERS

2.2.5.

THREAT OF COMPETITIVE RIVALRY

2.3. MARKET ATTRACTIVENESS INDEX

2.4. VENDOR SCORECARD

2.5. INDUSTRY COMPONENTS

2.5.1.

DAIRY/CHEESE INDUSTRY

2.5.2.

FOOD & BEVERAGE INDUSTRY

2.5.3.

VALUE-ADDED PRODUCT

2.5.4.

BIOETHANOL FUEL PRODUCTION

2.6. MANUFACTURING EXPENSES INVOLVED IN WHEY

PROTEIN INGREDIENTS MAKING PROCESS

2.7. MARKET DRIVERS

2.7.1.

GROWING AWARENESS OF WHEY PROTEIN INGREDIENTS

2.7.2.

HEALTH & WELLNESS PRODUCTS SHOW RISING TRENDS

2.8. MARKET RESTRAINTS

2.8.1.

RAW MATERIAL PRICE FLUCTUATIONS

2.8.2.

THE INDUSTRY IS HIGHLY FRAGMENTED IN NATURE

2.8.3.

HIGH COST OF MANUFACTURING

2.9. MARKET OPPORTUNITIES

2.9.1.

DEMAND FOR HIGH-QUALITY PROTEIN SUPPLEMENTS

2.9.2.

HEALTH-CONSCIOUS CONSUMERS ON THE RISE

2.9.3.

GROWTH OF PACKAGED & SPECIALTY FOOD

2.10. MARKET CHALLENGES

2.10.1.

INCIDENCE OF DISEASES FROM FARM ANIMALS REDUCES ADOPTION OF FARM

PRODUCTS

2.10.2.

HEALTH-RELATED PROBLEMS FROM WHEY PROTEIN INGREDIENTS

3. NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET

OUTLOOK - BY TYPE (IN TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME:

KILOTONS)

3.1. WPI

3.2. WPC 80

3.3. WPC 50-79

3.4. WPC 35

3.5. DWP

3.6. WPH

4. NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET

OUTLOOK - BY END-USER (IN TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME:

KILOTONS)

4.1. BAKERY & CONFECTIONERY

4.2. DAIRY PRODUCTS

4.3. FROZEN FOODS

4.4. SPORTS NUTRITION

4.5. BEVERAGES

4.6. MEAT PRODUCTS

4.7. MEDICINE

4.8. OTHERS

5. NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET

OUTLOOK - BY APPLICATION (IN TERMS OF VALUE: $ MILLION & IN TERMS OF

VOLUME: KILOTONS)

5.1. FUNCTIONAL FOODS & BEVERAGES

5.2. INFANT NUTRITION

5.3. SPORTS FOOD & BEVERAGES

5.4. CLINICAL NUTRITION

5.5. OTHER APPLICATIONS

6. NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET

- REGIONAL OUTLOOK (IN TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME:

KILOTONS)

6.1. UNITED STATES

6.2. CANADA

7. COMPANY ANALYSIS

7.1. CARGILL, INCORPORATED

7.2. DANONE S.A.

7.3. ARLA FOODS

7.4. FONTERRA CO-OPERATIVE GROUP LIMITED

7.5. OMEGA PROTEIN

7.6. ERIE FOODS INTERNATIONAL, INC.

7.7. GRANDE CUSTOM INGREDIENTS

7.8. AGROPUR MSI, LLC

7.9. AMERICAN DAIRY PRODUCTS INSTITUTE

7.10. LEPRINO FOODS, CO.

7.11. MEGGLE GROUP

7.12. MILK SPECIALTIES

7.13. WARRNAMBOOL CHEESE AND BUTTER FACTORY

7.14. WESTLAND MILK PRODUCTS

7.15. SAPUTO INGREDIENTS

8. RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

TABLE 2: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY,

2019-2027 (IN KILOTONS)

TABLE 3: VENDOR SCORECARD

TABLE 4: WHEY POWDER MANUFACTURING EXPENSES IN PERCENTAGE

TABLE 5: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY TYPE,

2019-2027 (IN $ MILLION)

TABLE 6: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY TYPE,

2019-2027 (IN KILOTONS)

TABLE 7: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY END-USER,

2019-2027 (IN $ MILLION)

TABLE 8: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY END-USER,

2019-2027 (IN KILOTONS)

TABLE 9: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY APPLICATION,

2019-2027 (IN $ MILLION)

TABLE 10: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY APPLICATION,

2019-2027 (IN KILOTONS)

TABLE 11: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

TABLE 12: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY,

2019-2027 (IN KILOTONS)

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY WPI,

2019-2027 (IN $ MILLION)

FIGURE 5: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY WPC, 80,

2019-2027 (IN $ MILLION)

FIGURE 6: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY WPC, 50-79,

2019-2027 (IN $ MILLION)

FIGURE 7: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY WPC, 35,

2019-2027 (IN $ MILLION)

FIGURE 8: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY DWP,

2019-2027 (IN $ MILLION)

FIGURE 9: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY WPH, 2019-2027

(IN $ MILLION)

FIGURE 10: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY BAKERY

& CONFECTIONERY, 2019-2027 (IN $ MILLION)

FIGURE 11: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY DAIRY

PRODUCTS, 2019-2027 (IN $ MILLION)

FIGURE 12: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY FROZEN

FOODS, 2019-2027 (IN $ MILLION)

FIGURE 13: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY SPORTS

NUTRITION, 2019-2027 (IN $ MILLION)

FIGURE 14: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY BEVERAGES,

2019-2027 (IN $ MILLION)

FIGURE 15: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY MEAT

PRODUCTS, 2019-2027 (IN $ MILLION)

FIGURE 16: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY MEDICINE,

2019-2027 (IN $ MILLION)

FIGURE 17: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY OTHERS,

2019-2027 (IN $ MILLION)

FIGURE 18: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY FUNCTIONAL

FOODS & BEVERAGES, 2019-2027 (IN $ MILLION)

FIGURE 19: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY INFANT

NUTRITION, 2019-2027 (IN $ MILLION)

FIGURE 20: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY SPORTS FOOD

& BEVERAGES, 2019-2027 (IN $ MILLION)

FIGURE 21: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY CLINICAL

NUTRITION, 2019-2027 (IN $ MILLION)

FIGURE 22: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY OTHER

APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 23: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, REGIONAL

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 24: UNITED STATES WHEY PROTEIN INGREDIENTS MARKET, 2019-2027 (IN

$ MILLION)

FIGURE 25: CANADA WHEY PROTEIN INGREDIENTS MARKET, 2019-2027 (IN $

MILLION)